The global hydraulic market is dominated by a few corporate giants. Their massive scale makes it seem impossible for independent distributors to compete, creating fear that the industry is becoming a monopoly.

Yes, small distributors have a vital place. They thrive by offering what corporations cannot: agility, deep niche expertise, and personalized local service. They succeed by being an indispensable partner to their community, not by competing on a global scale.

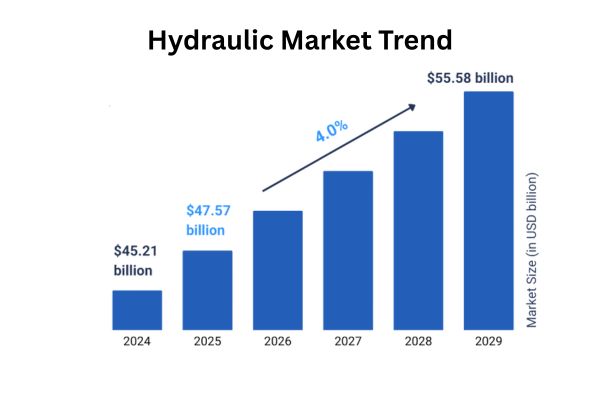

The hydraulics industry is a titan of global commerce. Forecasts project its market value to climb into the tens of billions, driven by growth in construction, oil and gas, and automation. A handful of household names—Parker Hannifin, Danfoss, Bosch Rexroth—represent a colossal share of this market, employing hundreds of thousands and generating revenues that dwarf the economies of small countries. This landscape can be intimidating. When faced with such overwhelming scale, the question naturally arises: in an industry of giants, does the small, independent distributor still have a fighting chance? The answer is not just yes, but that they are a fundamentally necessary component of the entire industrial ecosystem. Their value is not measured by market share, but by their irreplaceable role on the ground.

How Large is the Hydraulic Market Really?

You see the same big brand names everywhere and wonder if they control the entire market. This perception can make it feel like there are no other options for sourcing components.

The five largest fluid power companies generate around $47 billion in total revenue. While they are a dominant force, the overall market is vast, with significant growth projected, particularly in North America.

A Look at the Numbers

To grasp the dynamics of the industry, one must first appreciate its scale. The global hydraulics market is valued at nearly $40 billion and is projected to grow at a compound annual growth rate (CAGR) of around 2.4%. For a mature industry, this is a sign of robust health and sustained demand. The outlook is even stronger in key regions like North America, where a CAGR of 5-6% is anticipated, fueled by sectors like energy, construction, and factory automation.

The giants of the industry are truly massive. Companies like Parker Hannifin, Danfoss, Bosch Rexroth, SMC, and Festo collectively employ a workforce nearing 177,000 people and generate tens of billions in annual revenue across all their business segments. Their influence is undeniable. They drive innovation, set de facto standards, and have the resources to engage in massive R&D projects, from complex motion control systems to Industry 4.0 integration. It is estimated that these giants, along with other large to mid-size players like Hydac or Motion Industries, account for a staggering 75-80% of the total fluid power market. This concentration of power understandably leads smaller players to question their own position and future.

Where Do Small Distributors Find Their Niche?

With giants controlling up to 80% of the market, it seems like there are only scraps left for everyone else. This can be demoralizing for a small business owner trying to build a future.

Small distributors thrive in the remaining 20-25% of the market. They succeed by not competing with the giants directly, but by serving the customers and needs that the corporate structure is not designed to address.

The Vital 20 Percent

The fact that 75-80% of the market is held by large corporations might seem like a death knell for small businesses, but the reality is more nuanced. The remaining 20-25%, worth billions of dollars, is where independent distributors flourish. Their survival is not predicated on taking market share from the giants, but on providing a type of value that is fundamentally different. A large corporation is built for scale, efficiency, and serving large OEM or national accounts.

A local distributor is built for flexibility, responsiveness, and serving the immediate, often unpredictable, needs of a local community. Bosch Rexroth will not open a small hose shop next to a local steel mill to handle emergency repairs. Danfoss will not dispatch a technician to help a municipal crew fix a broken salt spreader by the side of the road. These are the gaps that the giants, by their very nature, cannot and will not fill. This is the fertile ground where the two-to-twelve-employee distributorship plants its flag. Their success is defined not by global reach, but by indispensable local presence.

What is the Unique Value Proposition of a Local Shop?

As a buyer, you are often forced to choose between the huge catalog of a national supplier and the convenience of a local store. You need the expertise and speed of a local shop but worry they can’t compete on price.

Local distributors offer flexibility, personalized service, and deep niche expertise that large corporations cannot replicate. They provide immediate solutions and build relationships, becoming a trusted partner rather than just a parts supplier.

Competing on Value, Not Volume

The power of a small distributor lies in its ability to offer things that do not appear on a balance sheet but are immensely valuable to the end customer.

- Flexibility and Speed: A farmer with a broken harvester during planting season cannot wait three days for a part to ship from a central warehouse. They need a replacement hose built *now*. The local shop, with its inventory of hydraulic fittings and bulk hose, can fabricate a custom assembly in minutes while the customer waits. This level of immediate problem-solving is a service a large, centralized operation cannot match.

- Niche Expertise: The team at a local shop in a logging region will have an encyclopedic knowledge of the specific fittings and pressure requirements for skidders and feller bunchers. A distributor near a port will understand the corrosive challenges of marine hydraulics. This deep, specialized knowledge, gained over years of hands-on experience with local industries, is a powerful asset that instills confidence and ensures the right part is provided the first time.

- Personal Relationships: In a local shop, the buyers, maintenance managers, and repair technicians are known by name. The distributor understands their equipment, their typical problems, and their budget constraints. This relationship builds a level of trust and loyalty that transcends simple price comparisons. Customers stick with the shop that understands their business and helps them succeed.

| Feature | Large National Distributor | Local Specialist Distributor |

| Service Model | Process-driven, standardized, centralized support. | Flexible, relationship-based, on-the-spot problem-solving. |

| Expertise | Broad knowledge of a vast product catalog. | Deep, specialized knowledge of local industries (e.g., agriculture, mining). |

| Response Time | Can involve call centers and standard shipping times. | Immediate fabrication and over-the-counter service. |

| Customer Focus | Large OEMs, national contracts, high-volume accounts. | Small to medium businesses, repair shops, walk-in emergencies. |

| Value Proposition | One-stop-shop for major brands, extensive catalog. | Speed, customized solutions, expert advice, and trust. |

Is Corporate Acquisition the Real Existential Threat?

The biggest fear isn’t always being outcompeted by a giant manufacturer, but being bought out by a giant distributor. This can feel like a loss of independence and local identity.

Acquisition by larger distributors like Motion Industries or SunSource is a more likely scenario than being forced out of

A Nuanced Transition

While the David vs. Goliath narrative is compelling, the more common story in the modern fluid power landscape is one of consolidation. Large national and super-regional distributors are actively growing by acquiring smaller, successful independent shops. This is often misinterpreted as a purely predatory act, but the reality is more complex. For a small business owner nearing retirement with no succession plan, an acquisition can be a golden parachute, ensuring their life’s work continues and their employees keep their jobs.

The acquiring company often sees the value in the existing team and local brand recognition, choosing to keep the original staff and even the former owner on as a branch manager. This provides the local shop with powerful new advantages: access to a much broader inventory, sophisticated ERP and HR systems, professional training resources, and enhanced buying power. While some of the original autonomy is lost, the shop’s ability to serve its customers can be greatly enhanced. It’s a trade-off that many owners find beneficial for the long-term health of the business and its employees.

Why Do Manufacturers Still Need Small Distributors?

With their global reach and sophisticated logistics, why don’t major manufacturers just sell directly to everyone? It seems more efficient to cut out the middleman entirely.

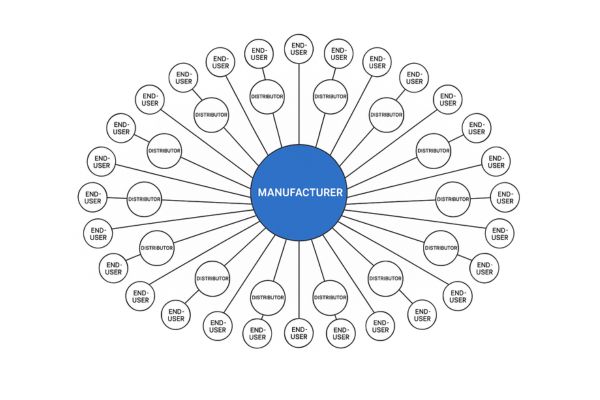

Manufacturers rely on the vast, decentralized network of small distributors to act as their sales and support force. It is far more cost-effective than hiring a sales team large enough to reach every small machine shop and repair facility.

A Symbiotic Relationship

The fluid power industry is built on a foundation of mutual respect and codependence between manufacturers and distributors. A major brand like Parker or Danfoss could, in theory, attempt to sell directly to every end-user. However, the cost of such an endeavor would be astronomically prohibitive. They would need to hire, train, and manage a sales force of thousands to visit every farm repair shop in rural Pennsylvania, every machine shop in a small Texas town, and every fishing boat mechanic in a coastal village. It’s an logistical and financial impossibility.

Instead, they wisely leverage the existing network of hundreds of independent distributors. These local shops function as the manufacturer’s “last mile” delivery system, providing sales, technical support, and immediate product availability in markets the manufacturer could never efficiently reach on its own. This symbiotic relationship allows the manufacturer to focus on what it does best—engineering and producing high-quality components at scale—while the distributor focuses on what it does best—building relationships and solving problems for the local customer base.

How Can Modern Small Distributors Ensure Their Future?

Knowing that a niche exists is one thing; successfully occupying and defending it is another. What must a small distributor do today to remain relevant and profitable for years to come?

Success hinges on embracing their core strengths while modernizing their operations. This means deepening niche specialization, leveraging technology for efficiency, and, most importantly, forging strong partnerships with reliable suppliers.

A Blueprint for Success

The continued success of the local distributor is not guaranteed; it must be earned. The path forward involves a blend of traditional values and modern strategy.

- Double Down on Specialization: Instead of trying to be everything to everyone, the most successful small distributors become the undisputed experts in a specific local industry. Whether it’s the hydraulic systems on combine harvesters or the complex plumbing of plastic injection molding machines, becoming the go-to resource for a specific application builds a protective moat around the business that large, generalist suppliers cannot cross.

- Embrace Appropriate Technology: A small shop doesn’t need a complex ERP system, but it does need good inventory management software to avoid stockouts on critical items. It needs a professional, easy-to-navigate website that allows local customers to see their capabilities. They can use social media to showcase completed projects and share expertise, reinforcing their position as a local authority.

- Forge Strong Supplier Partnerships: The local distributor is only as good as the components they sell. Aligning with a supplier partner who understands their business model is critical. This means finding a supplier that doesn’t just offer parts, but offers support. A great supplier provides competitive pricing, guarantees quality, maintains consistent stock, and offers technical assistance when needed. This frees up the distributor to focus on their customers, confident that their supply chain is secure. This is the model that allows a small shop to punch above its weight.

Conclusion

The hydraulic industry is large enough for businesses of all sizes to coexist and prosper. Small distributors are not an endangered species; they are a vital, adaptable part of the ecosystem, thriving on a foundation of service, expertise, and relationships.

As a manufacturer that values the role of distributors, Topa is committed to being the ideal supplier partner. We provide high-quality hydraulic fittings, hoses, and components with competitive pricing and the unwavering support you need to serve your customers effectively. Partner with us to secure your supply chain and grow your business.